Unit depreciation calculator

You can browse through general categories of items or begin with a keyword search. Enter the value that you want to calculate depreciation.

Depreciation Expense Calculator Best Sale 57 Off Www Ingeniovirtual Com

We can calculate the accelerated.

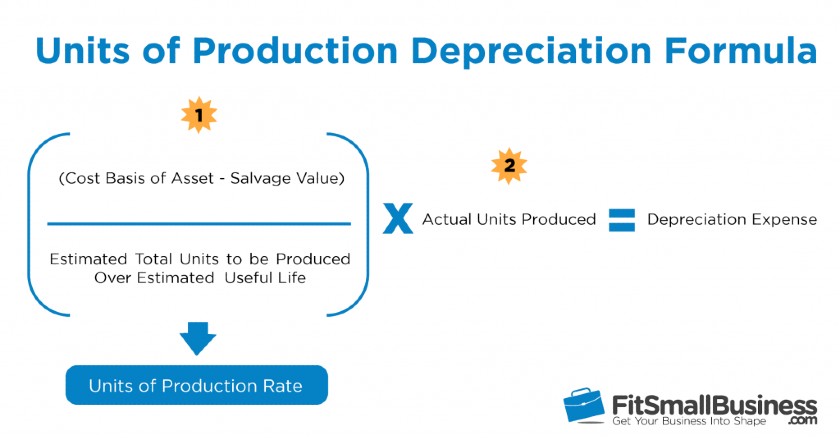

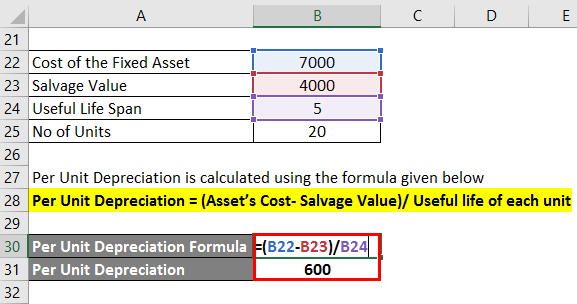

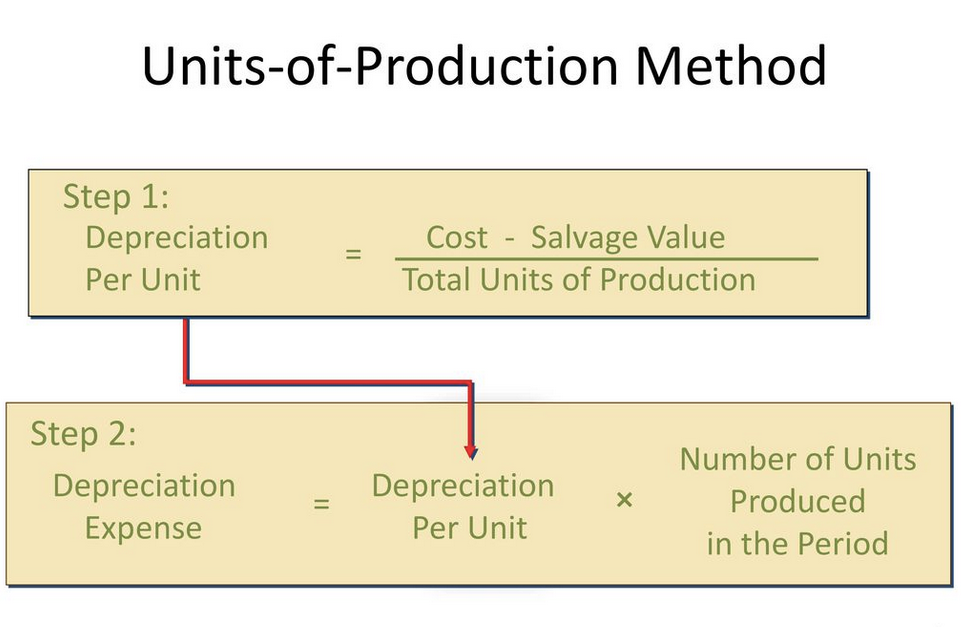

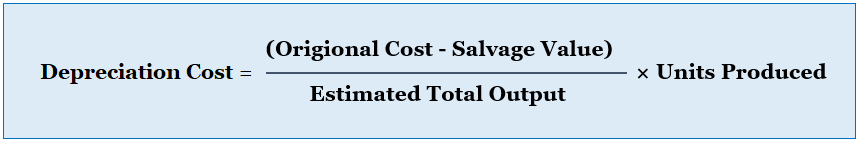

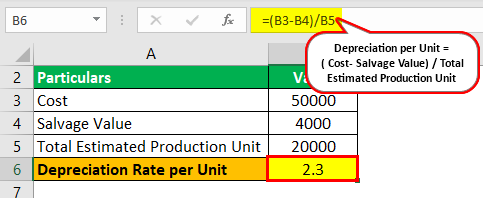

. Units of production depreciation calculator is made to help users in the quick calculation of depreciation as per this method. Depreciation expense depreciable cost per unit x units of production during the period Depreciable cost per unit depreciable cost estimated units of useful life Depreciable cost. The decrease in the value of an asset due to the normal wear and tear time effect and due to the obsolescence etc is called depreciation.

The Depreciation Calculator computes the value of an item based its age and replacement value. Asset cost - salvage valueestimated units over assets life x actual units made. It assumes MM mid month convention.

Straight Line Depreciation Calculator Reducing Balance Method Depreciation Calculator. These are set at 1 base currency unit. Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of.

The unit of production depreciation is. Then you multiply this unit cost rate. -- Enter Asset Value-- Enter Salvage Scrap Value-- Enter Total Production Life Units Expected.

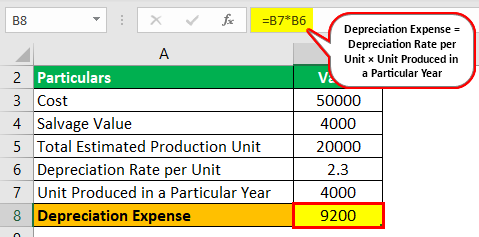

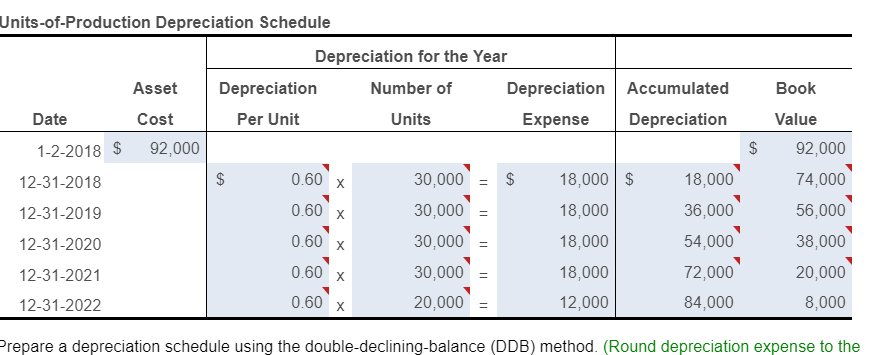

In case of an asset registered at an initial value of 500000 with a salvage value of 25000 at the end a total useful units of 50000 while the number of units in a period is considered to be. Calculating Depreciation Using the Units of Production Method. Depreciation calculators online for primary methods of depreciation including the ability to.

Units of Output Service Output Depreciation Calculator. It is fundamentally an assessment of the unit delivered by the resource over its valuable life. This method cant apply where the machine.

Sum of years digits. Estimated Unit of Production. This calculator uses the units-of-production UOP depreciation method to compute both the depreciation per unit and total annual depreciation for an item given the items original.

Depreciation expense per hour 220000-200005000hours 40 per hour Depreciation expense for first year 40 1500 hours.

Depreciation Calculator

Unit Of Production Depreciation Method Formula Examples

Depreciation Expense Calculator Best Sale 57 Off Www Ingeniovirtual Com

Depreciation Expense Calculator Best Sale 57 Off Www Ingeniovirtual Com

Depreciation Formula Calculate Depreciation Expense

Calculating Depreciation Unit Of Production Method

Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Expense Calculator Best Sale 57 Off Www Ingeniovirtual Com

Unit Of Production Depreciation Method Formula Examples

Depreciation Formula Examples With Excel Template

Solved Asset Useful Depreciation Accumulated Depreciation Chegg Com

Unit Of Production Depreciation Method Formula Examples

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation Expense Using Units Of Production Method Wikiaccounting

Depreciation Formula Examples With Excel Template